Liberty International Conference 2017 Puerto Rico

Thanks to Guilford R. Robinson I can place here these very important notes to me.

Thanks to Guilford R. Robinson I can place here these very important notes to me.

Travel &

Liberty

Travel &

Liberty Residency & Business

Opportunities in Chile

Residency & Business

Opportunities in Chile

The Unrealized: Even libertarians

don't understand how

destructive regulations are

The Unrealized: Even libertarians

don't understand how

destructive regulations are Land Reform for Latin America:

Privatizing Public Land;

Legalizing Private Land

Land Reform for Latin America:

Privatizing Public Land;

Legalizing Private Land The Collapse of Socialism in

Venezuela

The Collapse of Socialism in

Venezuela

Seizing Opportunities unities:

Spreading Liberty Amidst

Crisis

Seizing Opportunities unities:

Spreading Liberty Amidst

Crisis The Exception to the Rule of Law

or the Corruption of

American Democracy

The Exception to the Rule of Law

or the Corruption of

American DemocracyLink:

The Economics of Fiscal

Policy

The Economics of Fiscal

PolicyHe presents arguments that he thinks politicians can understand. He talked about economic growth and how long it takes to double GDP, listing 5 ways government policy affects growth: monetary, trade, regulatory, rule of law, fiscal policy. Fiscal policy is basically spending and taxes. Large government requires either high taxes or high debt. Ideal is keep tax rates low. Compliance is much better if tax rates are low. Ideally tax only one time since everyone agrees capital formation is key to growth. This is an important issue since there may be 4 taxes on money directed to 'savings and investments.' If you immediately spend money, by contrast, then taxes are much less onerous. Also, the tax code should remain neutral wrt 'winners and losers. Initially federal tax code was 400 pages. Now it's 76k pages. Laffer curve exists. Progressives think peak maximum is ~70%? Regarding government spending, Rahn curve shows relationship between government as %GDP and growth rate of GDP. in 1870 advanced countries spent ~9% of GDP. Government expanded after the countries became wealthy. There are now >20 countries c flat taxes.

Blog is www.DanieljMitchell.wordpress.com. He writes daily entries.

Links to his articles about Switzerland:

Libertarian Philosophy and

Libertarian Politics: Allies or

Rivals?

Libertarian Philosophy and

Libertarian Politics: Allies or

Rivals? Liberty in Puerto

Rico

Liberty in Puerto

Rico Act 20 & 22: Are Puerto

Rico's Tax Breaks for

You?

Act 20 & 22: Are Puerto

Rico's Tax Breaks for

You? Jones Act: Unconstitutional

Protectionism

Jones Act: Unconstitutional

Protectionism

Protectionism in Peacetime, What

Enemies do in

wartime

Protectionism in Peacetime, What

Enemies do in

wartime PR's Debt Crisis, Origins and

Solutions

PR's Debt Crisis, Origins and

Solutions

Human Rights in Cuba: Past,

Present, Future

Human Rights in Cuba: Past,

Present, Future

Individual Liberty: The Spinal

Cord of the Wealth Generating

System

Individual Liberty: The Spinal

Cord of the Wealth Generating

System The US Federal Criminal Legal

System is Irrevocably

Broken

The US Federal Criminal Legal

System is Irrevocably

Broken Digging Deeper into Brazil's 2014

Presidential

Campaign

Digging Deeper into Brazil's 2014

Presidential

Campaign

Links:

Promoting Open Borders in an

Environment of Fear

Promoting Open Borders in an

Environment of Fear

The Imperatives for the True

Libertarian.

The Imperatives for the True

Libertarian.

Links:

Permaculture: Empowering

Individual and Community

Self-reliance

Permaculture: Empowering

Individual and Community

Self-reliance Corruption and Liberty in

Peru

Corruption and Liberty in

Peru Trade vs Plunder: Market vs

Government

Trade vs Plunder: Market vs

Government

Definition:

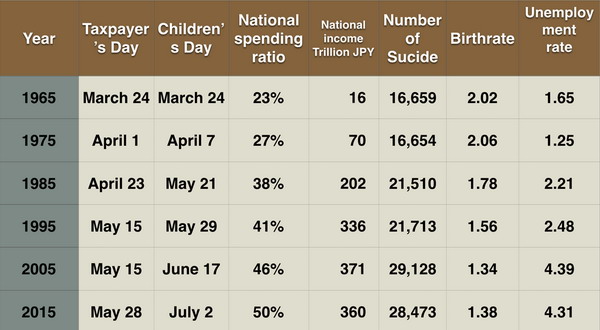

Japanese Children's Day is the day which the averaged Japanese should work to pay for whole government expenditure from new year day.

Purpose: Japanese government expenditure is too big to understand how big. Children's Day is the

tool to open taxpayer’s eyes. Children's Day Tells taxpayers how big the government spendings

are.

These statistic shows the decline of the welfare state. It proves that John Glubb was right.

Resources and Nationalism in

Mongolia

Resources and Nationalism in

Mongolia

Link:

Expansion of Economic Freedom and

Growth Opportunities for

Puerto Rico

Expansion of Economic Freedom and

Growth Opportunities for

Puerto RicoWhen asked what principles a good governor should follow he mentioned:

Raising Libertarian

Children

Raising Libertarian

Children Enemy of the

State

Enemy of the

State The Intersection between Wealth

and Health

The Intersection between Wealth

and Health

The Amazing Organic Growth of

Patient Consumerism in

Unexpected Places.

The Amazing Organic Growth of

Patient Consumerism in

Unexpected Places. Little Known Health Care

“Secrets”

Little Known Health Care

“Secrets” What are YOU going to do about

it?

What are YOU going to do about

it?